Top 5 Best Practices For Year-End Reconciliations

Why Is Year-End Closing Is Important?

Closing the fiscal year is a critical step in accounting to ensure your financial records are accurate and ready for the new year. It marks the point when all transactions for the fiscal year are finalized, and the accounting books are prepared for the upcoming period.

Let's look into the five most significant steps to consider in the reconciliation process and do not miss updating in your accounting software.

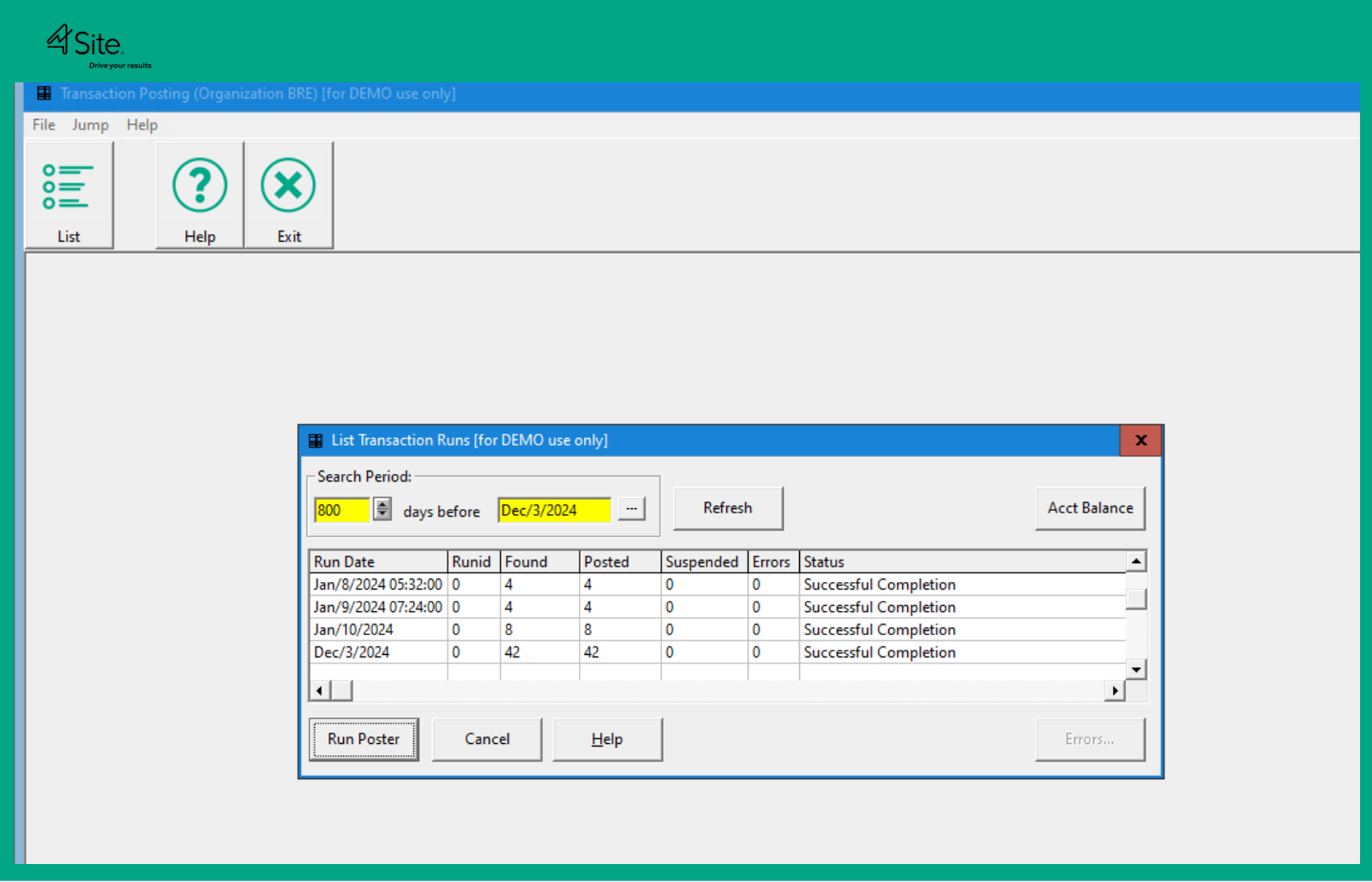

Step 1: Ensure All Transactions Are Entered and Posted

- Finalizing Transactions: Once all transactions have been posted and accounting periods are closed, no further modifications are allowed for the closed fiscal year. Only year-end adjustment journal entries can be recorded after closure, ensuring data integrity.

- Clearing Revenue and Expense Accounts: As part of the closing process, revenue and expense accounts are zeroed out. The net balance—whether a profit or loss—is transferred to the retained earnings account. This step ensures that the income statement starts fresh in the new fiscal year.

- Carrying Forward Account Balances: The balances of asset, liability, and equity accounts are carried forward as opening balances for the new fiscal year. This ensures continuity in tracking your organization's financial position.

- Transaction Dating: Any transactions created after the fiscal year is closed are automatically dated in the new fiscal year. This helps maintain clear boundaries between financial periods.

Important Considerations for Organizations

- Multi-Company Operations: If your organization includes multiple entities, each company must close its fiscal year individually to ensure accurate and consistent financial reporting.

- Irreversibility of Closure: Once a fiscal year is closed, it cannot be reopened. This underscores the importance of reviewing all transactions and adjustments thoroughly before proceeding.

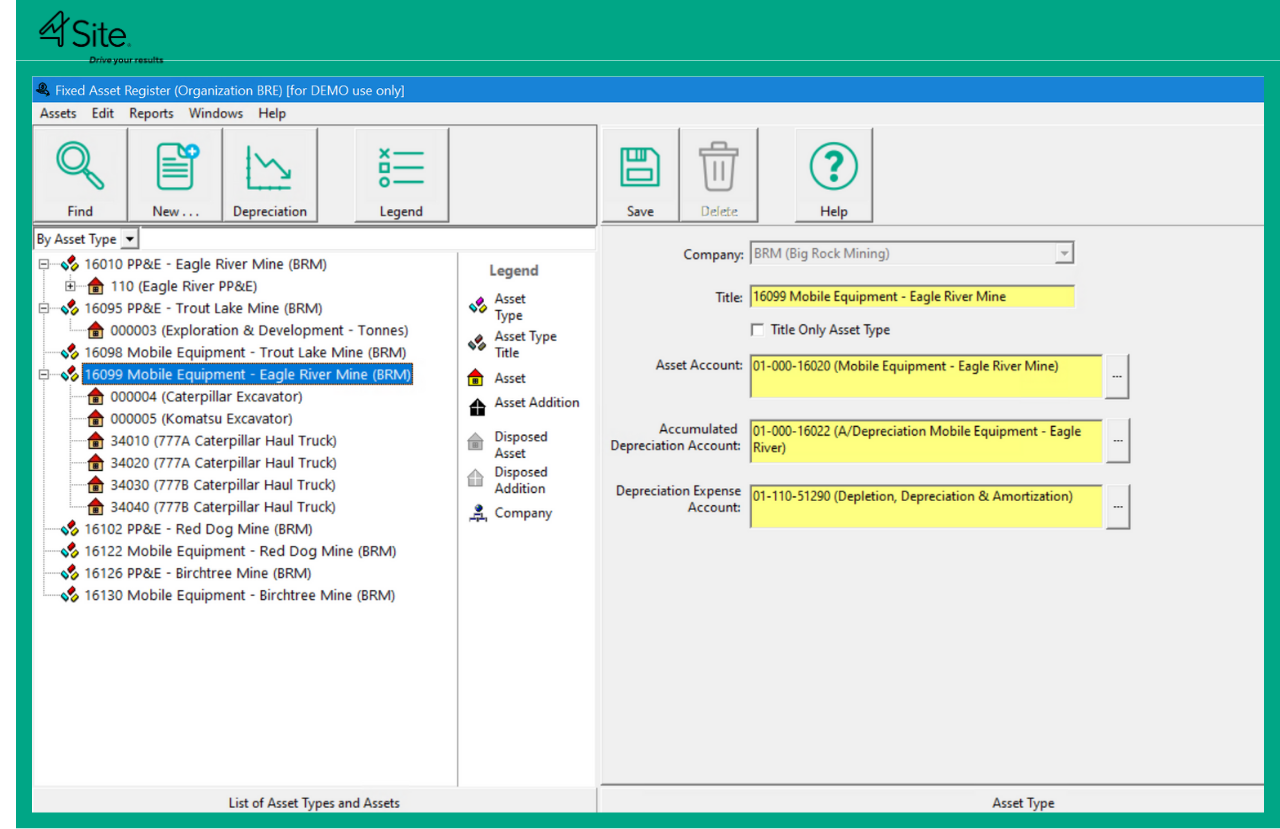

Img 1.1 Transaction Entry & Posting From 4Site Accounting Module

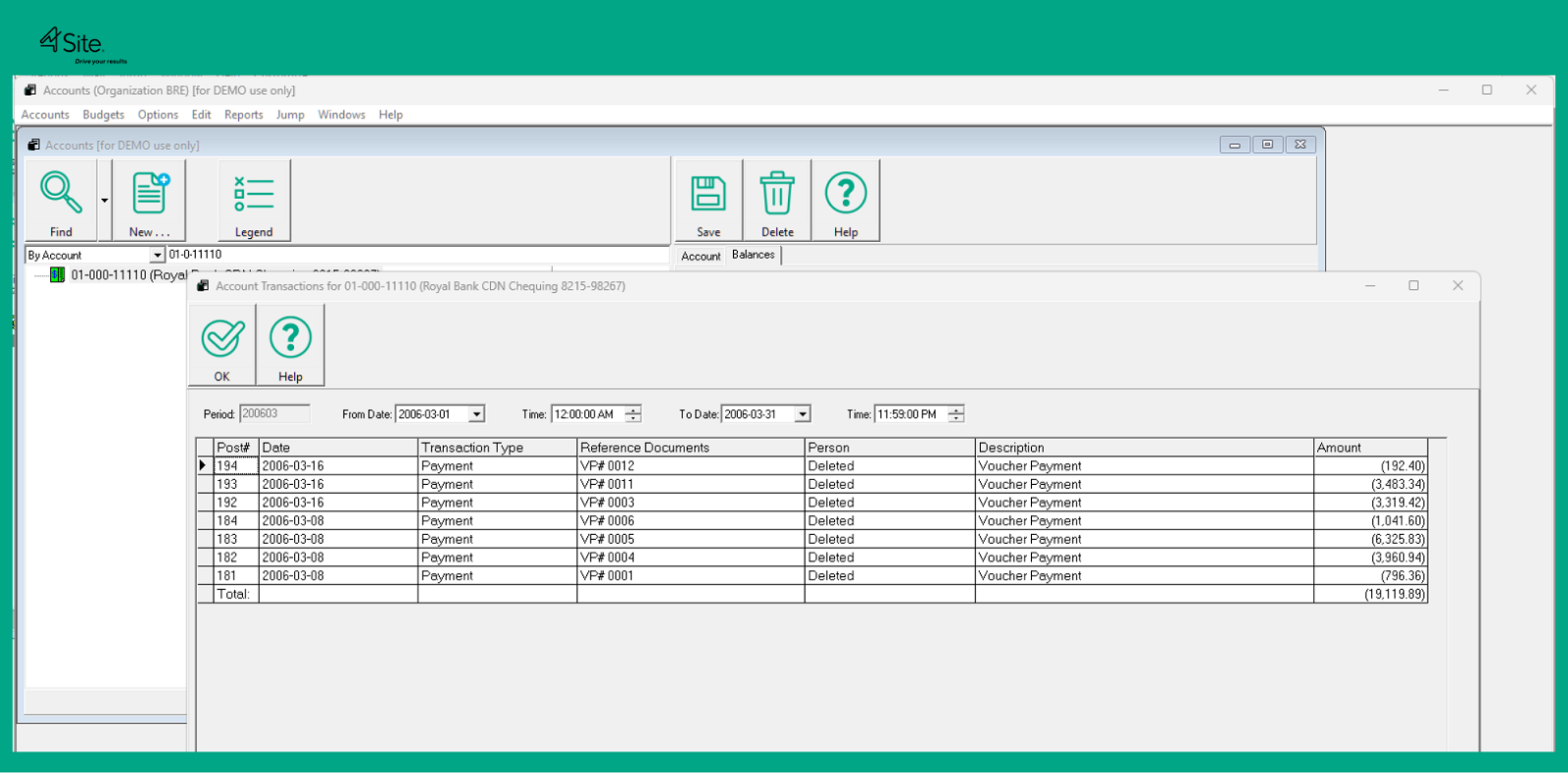

Step 2: Reconcile Bank Statements with AP & AR

Reconciling bank statements with accounts payable (AP) and accounts receivable (AR) is a critical year-end practice to ensure financial records are accurate and complete. Here's a detailed step-by-step explanation of the process

a. Gather Necessary Documents

- Bank Statements: Obtain all bank statements for the year from your financial institution.

- AP & AR Reports: Extract reports from your accounting system that list all transactions related to AP (outgoing payments) and AR (incoming payments).

- General Ledger: Have access to your ledger for cross-referencing.

b. Match Transactions from Bank Statements

- Cross-check transactions in your bank statement with entries in your AP and AR accounts.

- For AP: Ensure that payments to vendors, utilities, and other expenses recorded in your accounting system match the amounts and dates on the bank statement.

- For AR: Confirm that customer payments, refunds, and other income are recorded correctly in your system.

Img 1.2 Bank Receipts or Supplier Receipts Reconciliation

c. Identify Discrepancies

- Missing Transactions: Payments or deposits present in the bank statement but absent in the accounting system. For example, a direct debit or an automatic transfer that wasn't recorded.

- Duplications: Transactions recorded multiple times in the system but appear only once in the bank statement.

- Mismatched Amounts: Differences between amounts recorded in the system and those on the bank statement. These can occur due to data entry errors or bank fees not accounted for.

- Uncleared Checks or Deposits: Payments or deposits recorded in the accounting system but not yet reflected in the bank statement.

d. Make Adjustments

- Correct Errors: Update your accounting system to add missing transactions, correct duplications, and amend mismatched amounts.

- Record Bank Fees: Record bank charges, interest income, or other fees noted in the bank statement but not in your accounting system.

- Follow Up on Outstanding Items: Investigate uncleared checks, deposits, or other discrepancies. Communicate with the bank or relevant parties to resolve issues.

e. Verify Balances

- After adjustments, ensure that:

- The closing bank balance matches the adjusted balance in your accounting system.

- AP and AR balances are reconciled and align with corresponding bank transactions.

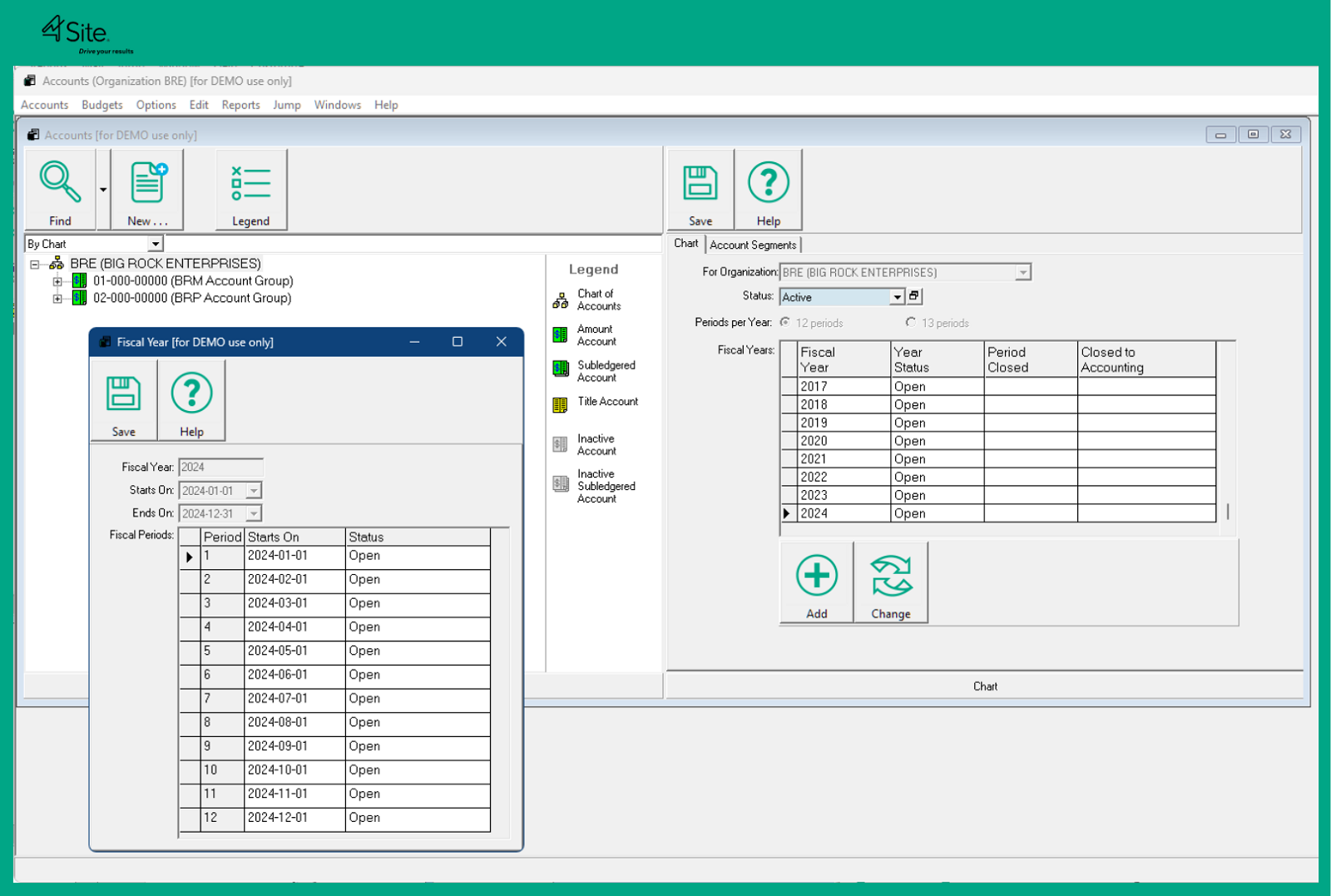

Img 1.2a Adjusting Fiscal Year Status In 4Site Accounting Module

Img 1.2a Adjusting Fiscal Year Status In 4Site Accounting Module

Step 3: Verify Fixed Assets and Depreciation

- Cross-Check Fixed Assets: Verify that all physical assets owned by the company match entries in the fixed asset register, ensuring no assets are missing or inaccurately recorded.

- Review Depreciation: Confirm that depreciation calculations align with the selected method (e.g., straight-line or declining balance) and the correct rates are applied, ensuring accurate expense reporting.

- Leverage Software for Automation: Use asset management software to automate depreciation calculations, update asset values, and generate reports, eliminating manual errors and saving time.

- Track Asset Lifecycle: Utilize software to monitor asset acquisitions, disposals, and transfers to maintain an accurate and up-to-date fixed asset register.

- Streamline Compliance: Automated systems ensure compliance with accounting standards and regulations, reducing the risk of discrepancies in financial reporting.

Img 1.3 Fixed Asset Register Pulled From 4Site Accounting Module

Step 4: Tax Compliance, Reports

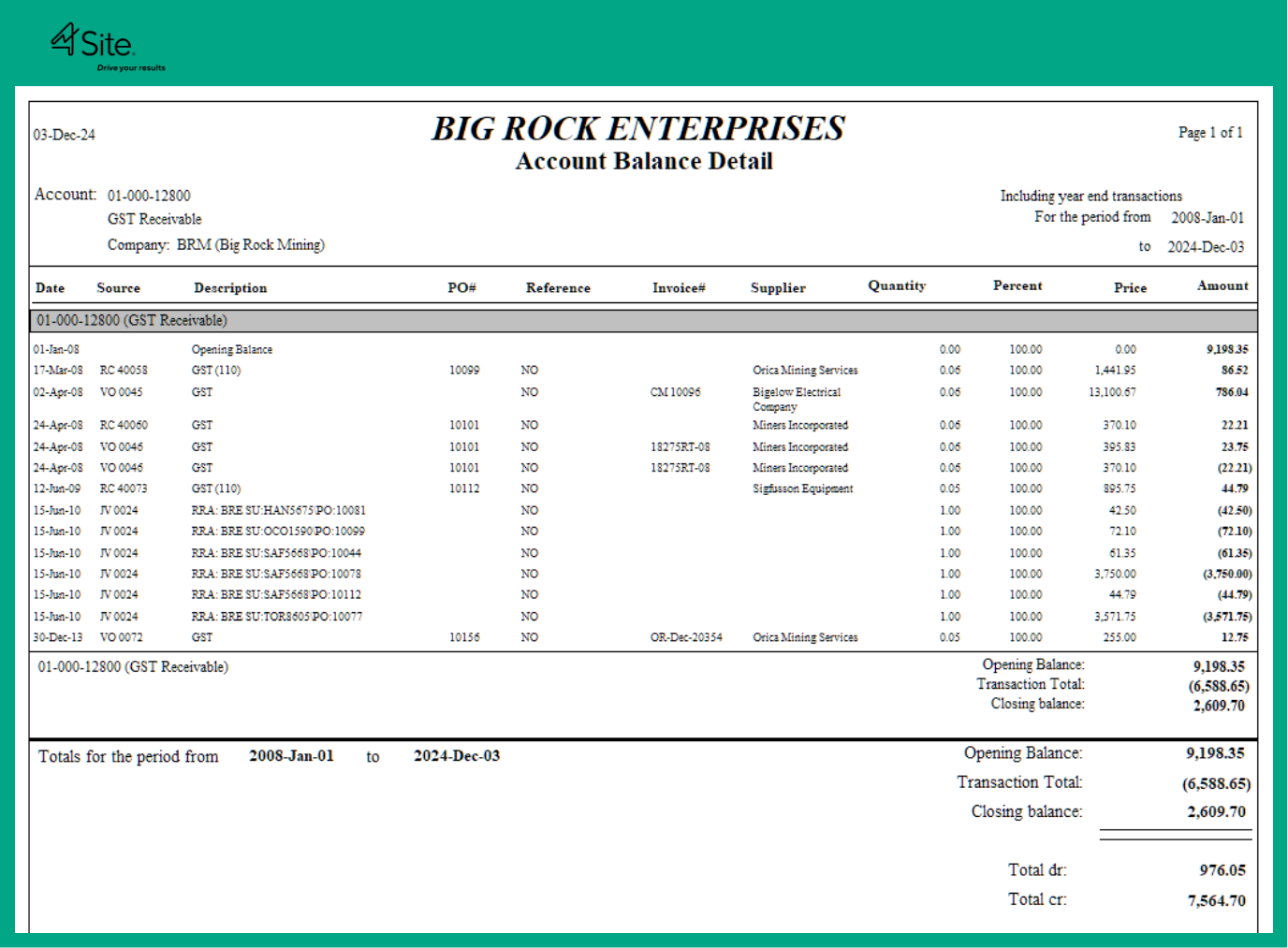

In year-end reconciliations, tax compliance involves reviewing and validating all tax-related data to ensure accurate reporting and adherence to regulatory requirements. The key tasks include:

- Reconcile Tax Accounts: Compare tax liabilities, payments, and receivables recorded in the accounting system against tax filings to identify discrepancies.

- Verify Input Tax Credits (ITC): Ensure that all eligible input tax credits, such as GST or VAT receivables, are accounted for and matched with corresponding invoices and purchases.

- Review Tax Payments: Confirm that all tax payments made during the year are accurately recorded and reconciled with bank statements.

- Prepare Year-End Tax Reports: Generate reports summarizing taxes collected, paid, and due, ensuring readiness for filings or audits.

- Identify Unclaimed Deductions: Review transactions to identify any missed tax deductions or credits that can be claimed before the filing deadline.

- Ensure Compliance with Changes: Verify that all tax calculations and filings comply with the latest tax regulations or rate changes.

Leveraging integrated software systems like 4Site, businesses can automate calculations, streamline reconciliations, and generate accurate reports, significantly reducing manual effort and the risk of errors. This ensures a smooth year-end process and avoids penalties for non-compliance.

Img 1.4 GST/HST, VAT payables and receivables

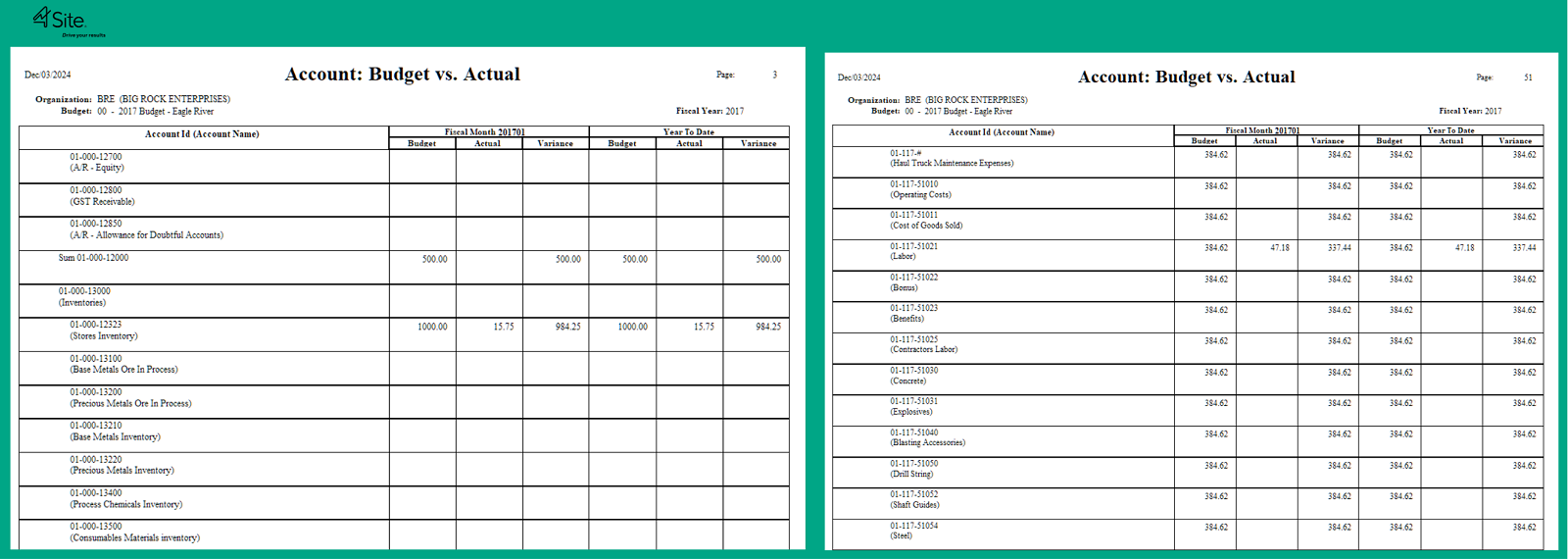

Step 5: Cross-Check Budget vs Actual Spending

- Compare Planned vs. Actual Expenditures: Use accounting or budgeting software to generate reports that highlight variances between budgeted figures and actual spending across departments or projects.

- Identify Overruns and Savings: Pinpoint areas where spending exceeded the budget or where savings occurred, helping evaluate financial discipline and operational efficiency.

- Analyze Variance Causes: Investigate significant variances to understand root causes, such as unexpected expenses or underutilized funds, and use insights to improve future planning.

- Automate Variance Reports: Leverage software to automate variance analysis and present data in easy-to-read dashboards or visualizations for better decision-making.

- Refine Future Budgets: Use findings to adjust budgeting strategies, set realistic goals, and allocate resources more effectively for the next fiscal year.

Budgeting tools and 4Site EAM/ERP system make this process efficient by integrating actual financial data with budget plans, offering accurate and actionable insights while reducing manual effort.

Img 1.5 Download reports to drill down into expenses and various categories

To Summarize:

- Ensure all transactions are posted, revenue and expense accounts are closed, and retained earnings are updated for data integrity.

- Cross-check bank transactions against AP/AR entries to resolve missing transactions, duplications, or mismatches.

- Confirm the accuracy of the fixed asset register and ensure correct depreciation calculations are applied.

- Reconcile tax liabilities and receivables, verify input tax credits, and ensure accurate tax reporting.

- Analyze budget variances, identify overruns or savings, and refine future budgets with actionable insights.

Within the 4Site integrated EAM system, businesses can make use of the accounting module to automate labor-intensive tasks, enhance accuracy, and streamline year-end reconciliation processes, leading to improved operational efficiency and compliance.